What is the best way to build the value of your MSP? It’s not what you might think.

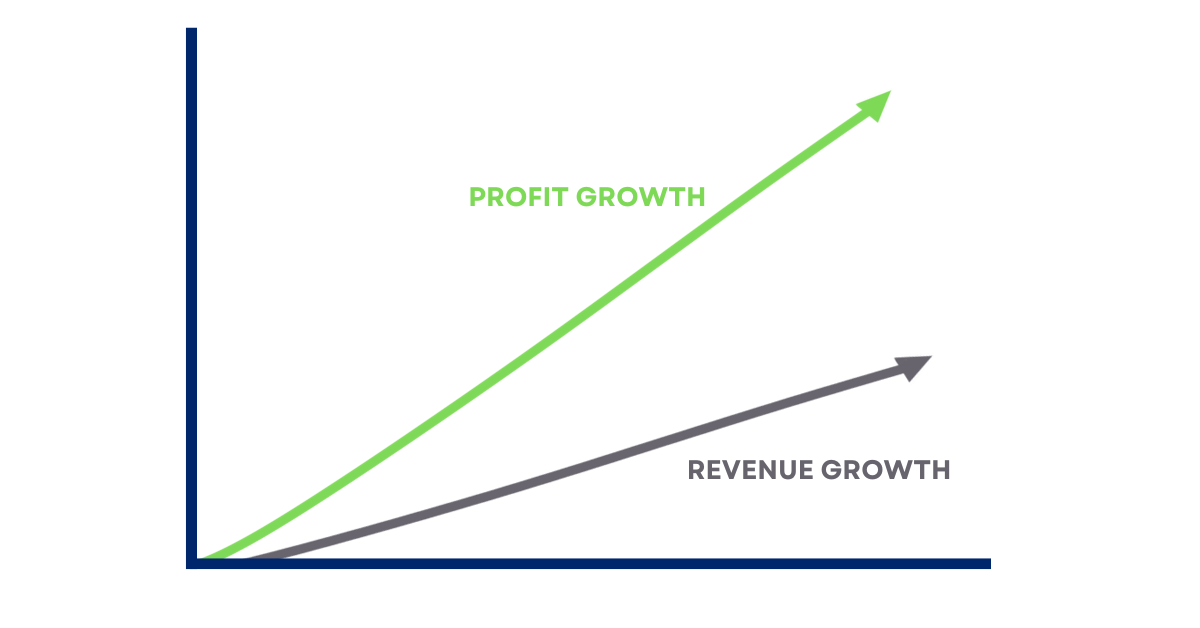

First, let’s debunk a common misconception: that the best way to increase your MSP’s value is to grow your top line of sales aggressively. If this is your plan, pause now! Hear us out on why focusing on your profit margin first is a better strategy (by a long shot).

We’ll let you in on some hard-earned wisdom: pushing your top line will only work if your MSP is already operating at a high level of profitability. The fact is, an MSP achieving high revenue but a low EBITDA % holds far less value than an MSP with lower revenue but a higher EBITDA %. That’s because the market favors a high EBITDA % as THE key indicator of an MSP’s ability to create and sustain profits into the future.

Attempting to rapidly grow your MSP’s sales without first fixing your profit margin is like putting water into a leaky bucket. It demands high investment and a dangerous potential for failure, creating an unacceptable (and unnecessary) risk of destructive financial and operational issues.

The good news? There’s a better way.

The proven best way to build your MSP’s long-term value at a low risk is to build or fix your profitability first. Then, you can build incremental revenues.

We’ll tell you why. Here is how buyers are valuing your MSP (and, by the way, how you should be thinking about your business, too):

-

- Revenue – All else being equal, an MSP with high revenue is more valuable than an MSP with low revenue. Nothing shocking here, but don’t be fooled into focusing on the obvious.

-

- Profitability – All else being equal, an MSP with a high EBITDA % is more valuable than an MSP with the same revenue but a low EBITDA %. Buyers want to invest in growing your MSP, not fixing it. If your profit margins aren’t up to par, buyers see your business as a chore rather than an opportunity.

-

- Growth Potential – An MSP that doesn’t need investment in order to increase profitability can grow faster. Strong margins allow your profits to fund your future growth strategy, rather than additional outside capital. Low profit companies just consume cash. Here’s an example: MSPs with proven sales & marketing strategies can turn the dial to maximize growth at any time; an MSP that requires investment to build up a sales strategy has a lower value.

-

- Scalability – An MSP’s ability to absorb growth without a negative impact on profits has a high value. If automation and efficiency-enhancing technologies are already in place, buyers don’t have to invest in them.

In short: if looking at your business model is like looking at a to-do list, it won’t be valued highly.

So, why not fix it all at once?

Unfortunately, it is impossible to rapidly grow revenue and fix profitability at the same time.

(Let us be clear: here at MSP Growth Solutions, we’re talking about best-in-class EBITDA %, in the 20% range. We believe our clients can achieve more than the median.)

Here’s why it doesn’t work: In order to rapidly grow revenue, there must be significant investment in sales & marketing. That’s a fact. And it takes time for this investment to generate incremental revenues. During this time, there will be inevitable added expenses that are not yet offset by new revenues, as gross margins will be less than optimal for a while.

On top of that, you will need additional headcount. Low gross margin operations require more staff than high gross margin operations, and as we all know, it is difficult and expensive to recruit and train high quality technical talent. You will spend time, effort, and money hiring technicians into an inefficient operation that will soon need a policy and practice overhaul in order to increase profits, anyways!

If you try to do it all at once, you will create a cycle of pouring unnecessary financial investments into a broken system. You can’t focus on fixing your profit margins if you’re too busy training an overload of staff in outdated operations!

Now that you know what not to do, we can tell you about the ideal way to make your MSP valuable:

Fix Profitability First.

Fixing your margins first allows you to put scalable processes and technology-driven efficiencies in place before your staff is grown, saving you tons of time wasted and decreasing your need for additional labor.

Maintaining a singular focus on improving profitability will drive results quicker, generating reliable, incremental gross margin dollars that can be reinvested to drive revenue growth in the future (remember: generating investable profits saves buyers from coughing up more cash!).

And profitability-focused sales & marketing strategy lays a strong foundation for dialing up and pushing revenue down the line.

At the end of the day, by prioritizing profitability first, both total investment and overall risk are significantly lowered while growing your MSP.

We know this works. But don’t just take our word for it; see it for yourself in this comparison of two real MSPs. One focused on rapid sales growth, and the other followed our profitability-first method. Again, this model is based on real experiences with two MSPs with the same base year revenues, gross margin, and net income. Valuations are based on real and recent industry transaction history.

The numbers speak for themselves! The MSP that focused solely on profitability wins consistently and significantly higher valuations than the MSP that focused on revenue growth. It took nine years for the revenue-focused MSP to catch up in valuation. We know you don’t have nine years to waste, and neither do we.

Achieve high valuation, quickly and reliably, with a profitability focus.

That’s quite a bit to digest, but if you made it this far, we’re confident we’ve gotten you on board with our profitability-first approach. And we won’t leave you hanging! Stick around to see our upcoming posts about how this method works in practice.